[ad_1]

Name of the Project

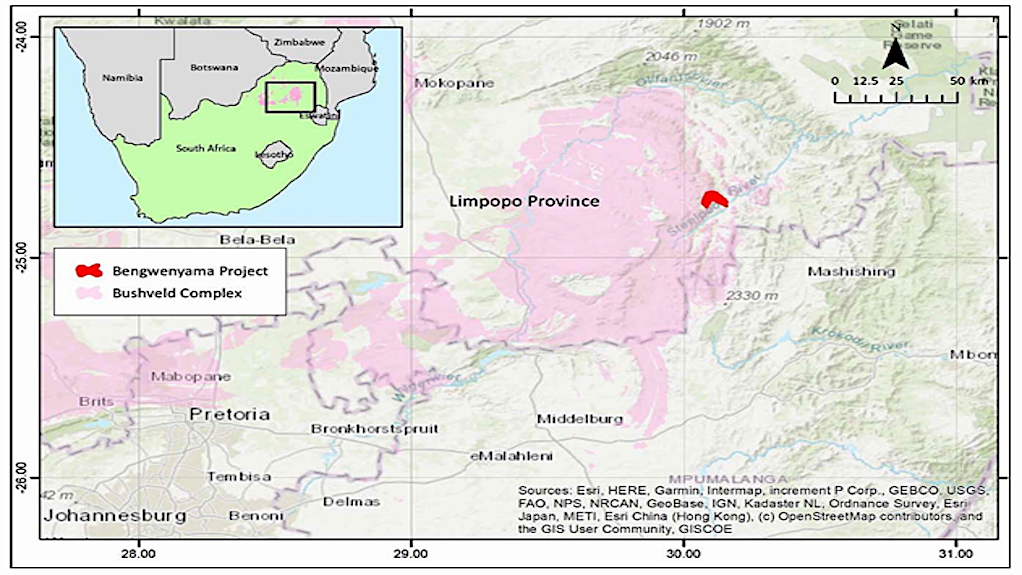

Bengwenyama platinum group metals (PGM) project.

Location

Bushveld Complex – greater Tubatse and Sekhukhune district municipalities, in Limpopo, South Africa, covering 5 280 ha on the farms Nooitverwacht 324 KT and Eerstegeluk 327 KT.

Project Owner/s

Australian public company Southern Palladium (70% owned).

Project Description

An optimised prefeasibility study (OPFS) on the advanced, shallow, high-grade PGM project proposes to unlock value through a staged production approach. The approach involves predevelopment of blocks using off-reef twin haulages, drives and centre gulleys (raises).

The project will use underground mining techniques, specifically for the upper group two reef. Stage 1 proposes a production rate of 1.2-million tonnes a year from the South decline only, expanding after four years to 2.4-million tonnes a year in Stage 2 with the introduction of the North decline.

Stage 1 is expected to deliver more than 200 000 oz/y of PGMs in concentrate. Total 6E (platinum, palladium, rhodium, ruthenium, iridium and gold) ounces recovered is estimated at 2.22-million ounces over the 23-year mine life.

Stage 1 and 2 total 6E production is estimated at 7.5-million ounces over the total 33-year life-of-mine (averaging more than 400 000 oz/y from Year 4 or possibly sooner for Stage 2). A well-established, standard processing technology has been adopted and optimised using current state-of-the-art (two-stage mill-and-float) infrastructure. PGM concentrates are expected to be processed at existing downstream refining facilities in South Africa. The company is also exploring off-site processing for Stage 1 to further reduce initial capital requirements.

Potential Job Creation

Specific numbers are not stated.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value (NPV), at an 8% discount rate, for Stage 1 and 2 of $857-million and an internal rate of return (IRR) of 26.4%. Stage 1 has an IRR of 21.8% and an NPV of $246-million.

Capital Expenditure

Peak funding is estimated at $279-million. Stage 1 is estimated at $219-million. Ongoing/expansion capital – Stage 1 and 2 – is estimated at $300-million.

Planned Start/End Date

Not stated.

Latest Developments

Near-term catalysts include the anticipated issue of the mining right and a fully funded infill drilling and metallurgical testwork programme for the planned definitive feasibility study.

Key Contracts, Suppliers and Consultants

Minxcon (consultants for OPFS).

Contact Details for Project Information

Southern Palladium, email info@southernpalladium.com.

[ad_2]

Source link

Leave a Reply